In 2021, British Columbia, Saskatchewan, Manitoba, and Ontario saw well above average wildfire seasons in terms of area burned. Nationally, 6,224 fires burned a total area of over 4.18 million hectares (compared to about 237,000 hectares in 2020). According to the Insurance Bureau of Canada, the severe wildfires in B.C. caused $77 million in insured damage in White Rock Lake and $102 million in Lytton.

Despite increasing wildfire risks, property owners can take steps to help mitigate damage to their property this wildfire season. To help you prepare, download these Risk Insights that outline common property fire hazards, building design considerations, as well as best practices before, during, and after a wildfire event:

Did you know that wildfires can increase the risk of flooding hazards?

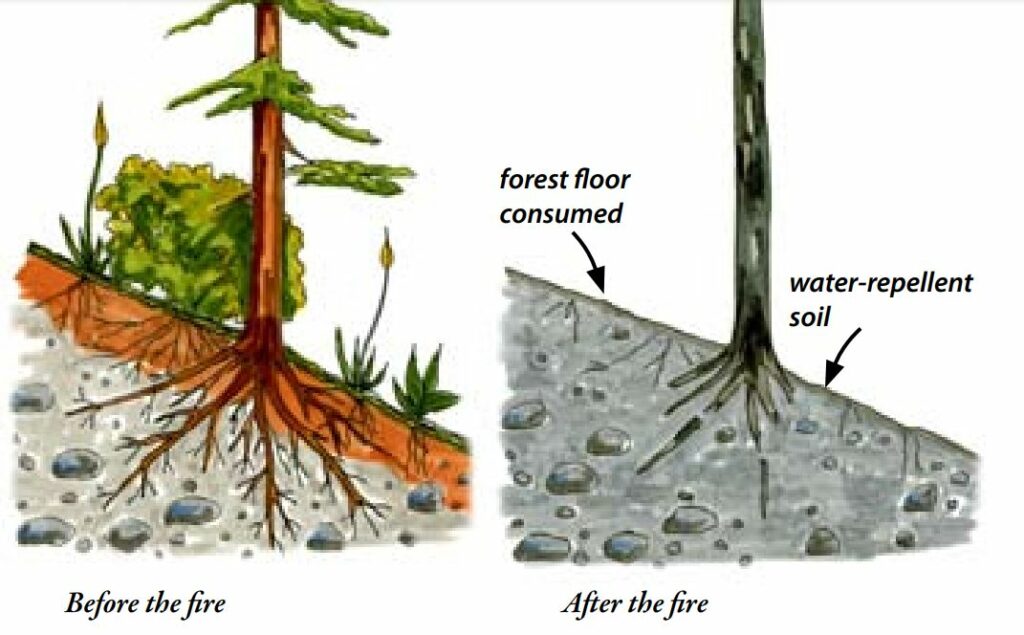

Large-scale wildfires change the terrain and ground conditions considerably. Rainfall is normally absorbed by plants, which reduces runoff. Wildfires, on the other hand, leave the ground charred, barren, and unable to absorb water, ripe for flash flooding and mudslides.

Wildfires can form a water repellent crust on the soil, resulting in increased runoff after intense rainfall (e.g. 10 mm of rain in 20-30 minutes) or rapid snowmelt. The IBC reported the B.C. floods in November 2021, after a season of severe wildfires, caused $515 million in insured damage. Flood risk can remain significantly higher up to five years after a wildfire.

River, coastal, surface water, and sewer flooding can also occur at any time of the year due to heavy rainfall, rapid snowmelt, or ice jams. The effects of flooding can be greatly reduced by taking preventative and precautionary measures. Develop a plan and be aware of available flood mitigation products with these Risk Insights from Northbridge Insurance:

Expert Advice from The Magnes Group

At the Magnes Group, we do things differently. With effort and care, we deliver the very best personalized insurance coverage and risk management advice. We serve businesses and individuals who appreciate quality, precision, and value in a way that many other insurance brokerages can’t or won’t.

As an independent insurance broker, we pride ourselves on providing straightforward, uncomplicated, and honest advice. We treat others as we would like to be treated ourselves. Not to increase market share but because it’s the right thing to do. You can rely on expert advice from the Magnes Group.

"*" indicates required fields